What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses

When Lucie purchases the shelving, the Equipment sub-ledger would only show half of the entry, which is the debit to Equipment for $5,000. Most popular accounting software today uses the double-entry system, often hidden behind a simplified interface, which means you generally don’t have to worry about double-entry unless you want to. You can hire an accountant and bookkeeper to do your business’s double-entry bookkeeping.

- A double-entry system provides a check and balance for each transaction, which helps ensure accuracy and prevent fraud.

- Debits do not always equate to increases, and credits do not always equate to decreases.

- When you make the payment, your account payable decreases by $780, and your cash decreases by $780.

The accounting equation

It is recommended to use a double-entry bookkeeping system because it allows for checks and balances on all transactions and the overall financial statement. This ensures that all financial statements are in good order and it can also help detect and prevent fraud within the business. Because you bought the inventory on credit, your accounts payable account also increases by $10,000. This is reflected in the books by debiting inventory and crediting accounts payable. The customer made a purchase using credit instead of cash, so it is the reverse of the prior scenario.

Preferred by Investors, Banks, and Buyers

If you’re a freelancer or sole proprietor, you might already be using this system right now. It’s quick and easy—and that’s pretty much where the benefits of single-entry end. Double-entry bookkeeping’s financial statements tell small businesses how profitable they are and how financially strong different parts of their business are. When you make the payment, your account payable decreases by $780, and your cash decreases by $780.

Table of Contents

First and foremost, it provides an organization with a complete understanding of its financial profile by noting how a transaction affects both credit and debit accounts. It also makes spotting errors easier, because if debits and credits do not match, then something is wrong. An example of double-entry accounting would be if a business took out a $10,000 loan and the loan was recorded in both the debit account and the credit account. The cash (asset) account would be debited by $10,000 and the debt (liability) account would be credited by $10,000. Under what is the average cost of utilities the double-entry system, both the debit and credit accounts will equal each other. When making these journal entries in your general ledger, debit entries are recorded on the left, and credit entries on the right.

If at any point this equation current portion of long term debt is out of balance, that means the bookkeeper has made a mistake somewhere along the way. Formally, the summarized list of all ledger accounts belonging to a company is called the “chart of accounts”. The early beginnings and development of accounting can be traced back to the ancient civilizations in Mesopotamia and is closely related to the development of writing, counting, and money. The concept of double-entry bookkeeping can date back to the Romans and early Medieval Middle Eastern civilizations, where simplified versions of the method can be found. The accounting system might sound like double the work, but it paints a more complete picture of how money is moving through your business.

The sum of every debit and its corresponding credit should always be zero. With double-entry accounting, when the good is purchased, it records an increase in inventory and a decrease in assets. When the good is sold, it records a decrease in inventory and an increase in cash (assets). Double-entry accounting provides a holistic view of a company’s transactions wave accounting 2020 and a clearer financial picture. The double-entry system of bookkeeping standardizes the accounting process and improves the accuracy of prepared financial statements, allowing for improved detection of errors.

The normal balance in such cases would be a debit, and debits would increase the accounts, while credits would decrease them. Once one understands the DEAD rule, it is easy to know that any other accounts would be treated in the exact opposite manner from the accounts subject to the DEAD rule. Double entry refers to a system of bookkeeping that, while quite simple to understand, is one of the most important foundational concepts in accounting.

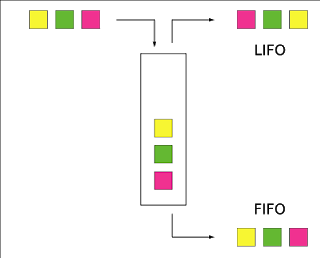

After all, your bank statement is credited when money is paid into your bank account. The system of bookkeeping under which both changes in a transaction are recorded together at an equal amount (one known as “credit” and the other as “debit”) is known as the double-entry system. Double-entry bookkeeping was developed in the mercantile period of Europe to help rationalize commercial transactions and make trade more efficient.

It also helped merchants and bankers understand their costs and profits. Some thinkers have argued that double-entry accounting was a key calculative technology responsible for the birth of capitalism. Accountants call this the accounting equation, and it’s the foundation of double-entry accounting.

The double entry accounting system is a method for companies of all sizes to accurately record the impact of transactions and keep close track of the movement of cash. It also provides an accurate record of all transactions, which can help to reduce the risk of fraud. Double-entry accounting is the system of accounting in which each transaction has equal debit and credit effects. Single-entry accounting is a system where transactions are only recorded once, either as a debit or credit in a single account. The balance sheet is based on the double-entry accounting system where the total assets of a company are equal to the total liabilities and shareholder equity. In the double-entry accounting system, transactions are recorded in terms of debits and credits.

Únete a la discusión